As part of our SD buyback transparency framework (see part 1 here), we are opening a formal discussion on the use of SD tokens acquired via quarterly buybacks. This is a critical step in aligning value accrual with the long-term interests of the protocol and its stakeholders.

The community is now invited to help decide how these tokens should be allocated.

Initial Buyback Pool and Distribution Schedule

There are already 562,000 SD tokens accumulated in the buyback wallet (0xEfe40fF167A89Ce3babdad161d41d798Ca7116b2). These tokens will be used alongside the ongoing quarterly buybacks and will be distributed gradually over the first 12 months following the activation of the selected distribution policy.

Option 1: Buyback and Burn

SD tokens are permanently removed from circulation by sending them to a burn address.

Examples of similar models include BNB, TRX, and VRTX.

Pros:

-

Deflationary model

-

Simple to implement and verify

-

Value accrues to remaining token holders

Cons:

-

No direct reward to protocol participants

-

No flexibility for future incentive programs

Option 2: Buyback and Distribute to SD Stakers

SD tokens are distributed to users who stake SD into the Stability Pool. This pool supports validator scalability by covering slashing risk without exposing stakers to direct validator performance.

For more information about the Utlity Pool, check here.

Pros:

-

Rewards long-term holders and protocol backers

-

Enhances ETHx validator growth

-

Clear token utility for stakers

Cons:

-

Excludes non-staking community members

-

Excludes new line of products (AI-powered trading via Cabbage)

-

No rewards for SD holders / stakers in Solana network

Option 3: Buyback and Distribute to Cabbage Traders

SD tokens are distributed to active users of the Cabbage platform, based on trading activity or performance. This strengthens engagement with the DeFi side of the ecosystem.

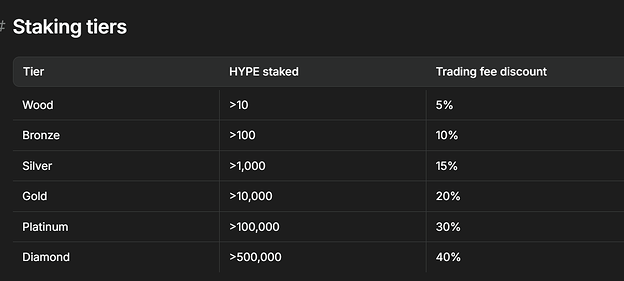

This is a similar approach used by other trading-focused apps, like Hyperliquid. See below their discounts according to staking tiers:

Pros:

-

Directly rewards active protocol users

-

Incentivizes trading and product adoption

Cons:

-

Excludes non-trading users that are bullish on Stader & Cabbage and want to get rewards in a more passive way, simply by Staking

-

No rewards for SD holders / stakers in Ethereum network

Option 4: Hybrid Distribution of 50% SD Stakers, 50% Cabbage Traders

A balanced approach between option 2 & option 3, where 50% of the SD buybacks are distributed to SD stakers in the Stability Pool, and 50% to active traders on Cabbage.

Pros:

-

Incentivizes both governance participation and product usage

-

Distributes rewards across user segments

-

Flexible structure for future tuning

Cons:

- More complex implementation

Broader Context: Toward Zero-Inflation

Distributing SD tokens from the buybacks will reduce the need for ongoing emissions. The SD emissions budget is currently published quarterly on the forum and outlines all incentive outflows.

Check the latest SD emissions budget (Aug 2025) here.

Currently, the protocol emits around 100,000 to 150,000 SD per month, while quarterly buybacks are already absorbing the equivalent of approximately 50,000 SD per month in market value. The long-term goal is to fully offset emissions through buybacks, eventually reaching net-zero token inflation. This goal is now within reach and requires careful alignment of incentives and execution.

Next Steps

Please use this thread to share your preferred option, any rationale, or alternative suggestions. Following this community discussion, we will proceed to a Snapshot vote to select the preferred distribution strategy.

The decision taken here will shape the value distribution framework for the next phase of Stader’s growth. Your input is critical !